The lesson consistently demonstrates methods for building cohorts, the relationship between dates and periods, and the formulas. Real scenarios for evaluating cohort metrics are shown.

A lesson for product managers and marketers who work with LTV, User Retention, Revenue Retention, Conversion Rate, and who want to start working with or already work with finance: P&L, unit economics. Without understanding and using cohorts, it is difficult to grow into a Senior position or CPO/CMO in data-driven companies where these roles are responsible for the P&L.

The lesson consistently demonstrates methods for building cohorts, the relationship between dates and periods, and the formulas. Real scenarios for evaluating cohort metrics are shown.

The goal of this lesson is to teach you how to correctly evaluate metrics that reflect reality only when calculated by cohorts: LTV, Revenue Retention, User Retention, Customer Retention, Conversion Rate, ARPPU, AOV, APC. For a specific period, you will be able to see that something has gone wrong with new users and understand which hypotheses delivered results. In total, there are more than 100 scenarios.

I will give recommendations on how to communicate these ideas to stakeholders.

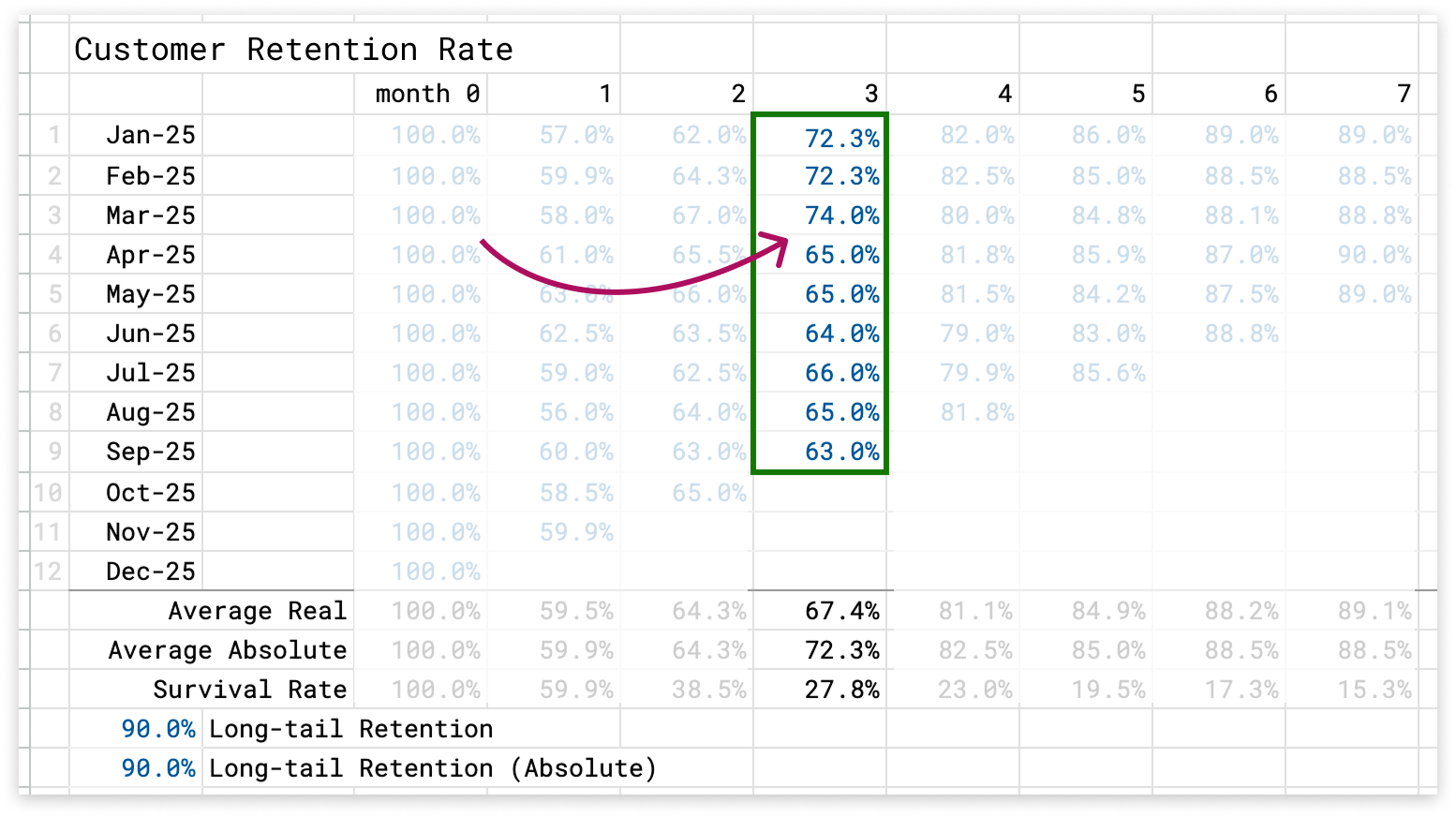

Cohort analysis shows that starting from April, something broke in the third month of the life cycle of all subsequent cohorts. It is possible that renewal notifications for the subscription stopped working.

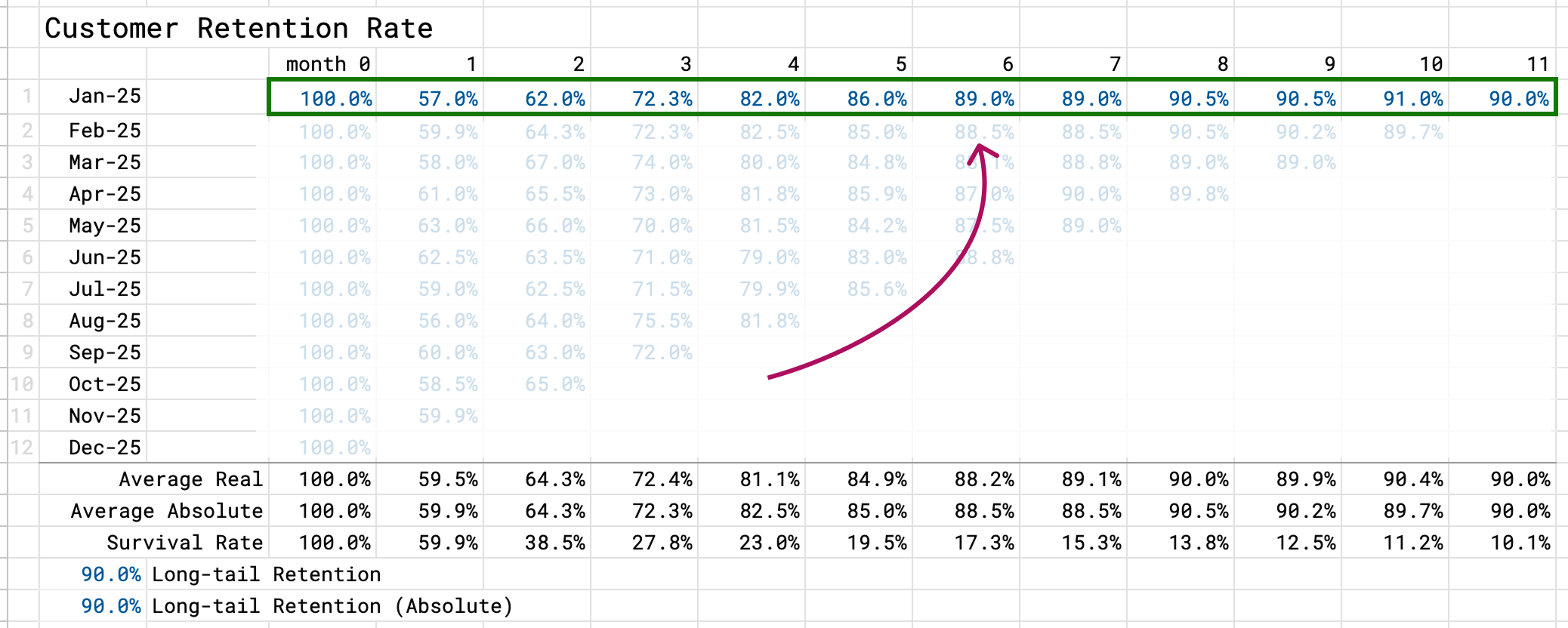

We look for the period when retention stabilizes, when only loyal customers remain. Starting from month 6 for the January cohort, approximately 90% of customers return in all subsequent months without sharp changes in the metric.

Without cohorts, it is easy to misinterpret your metrics and make wrong management decisions:

- start scaling an ad campaign that will generate losses

- keep a feature that kills your metrics

- miss a segment you should focus on.

This is not a typical lecture but a substantial lesson with theory and practice. It is more like a master class or simulator. Students watch 9 videos and complete 12 practical tasks where they learn about “scenarios, mistakes, metrics”.

The 3 hours of theory are split into 20‑minute blocks. Learn whenever it is convenient for you — progress is saved. It is clear that 3 hours at once is hard to get through. The practice should be done on a desktop, as it uses spreadsheets. And it is also preferable to watch the videos there.

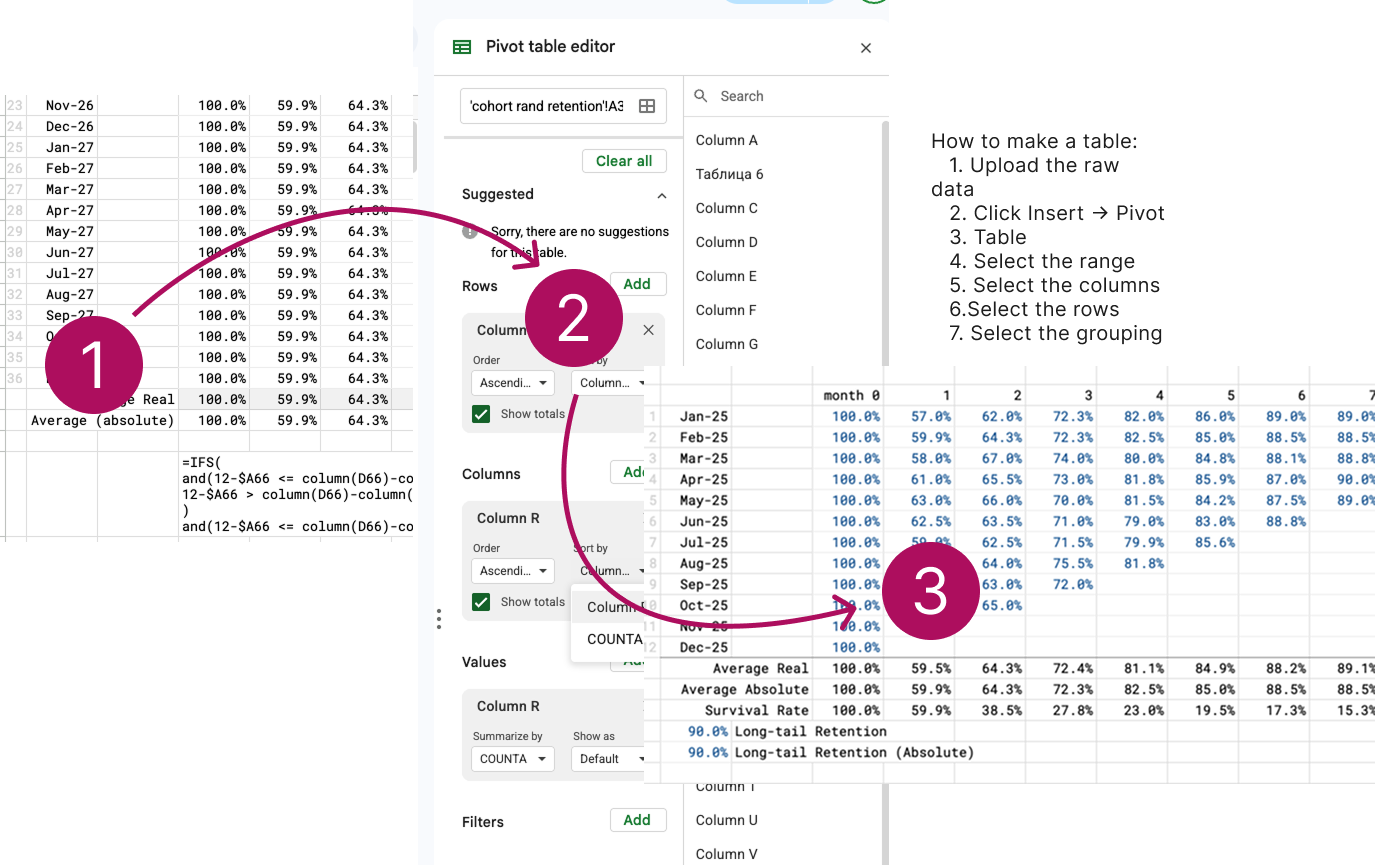

In this practical assignment, students learn how to group raw data into a cohort table.

- Google Sheets templates (we practice in Airtable, but everything is the same).

- Instructions for filling them in

- Requirements for analysts for setting things up in Power BI

- Templates for presenting results to management

- Action plans.

The main thing you will get after the lesson is action plans for working with Retention and for working with Acquisition.

The action plan for Retention includes a plan for Net Revenue Retention, Customer Retention, User Retention, cohort segmentation, and Power BI instructions.

The action plan for Acquisition includes C1, channels, long sales cycle, Power BI instructions, and the sales funnel.

Anastasia Sorokina / linkedin

Marketing Manager

When I went into this cohort analysis lesson, my hands were literally shaking. The commercial director had told me point‑blank: “Our current CAC is a disaster. If nothing changes, in a couple of months we’ll have to part ways.” I had already dug through all my channel reports, built pretty dashboards, but I still had no real understanding of where exactly we were burning money. During Alexey’s lesson, for the first time it became genuinely clear how to break the audience into cohorts so that the picture stops being chaos and turns into a story where you can see what happens to people after the first touchpoint.

What I really liked is that it wasn’t some boring academic breakdown. Alexey speaks like a normal person, without “analytics snobbery” and endless formulas. He shows everything with examples: here are cohorts by month of registration, here by month of payment, here’s how they behave across channels, and here is the real leak — not where people usually try to look for it. At some point I literally felt relieved: the problem wasn’t that I’m a “bad marketer”, but that I’d been looking at the data from a weird angle. In his explanation, cohort analysis stopped being a scary buzzword from books and turned into a working tool I could open the next morning and apply directly to my numbers.

After the lesson I just sat down and rebuilt my reports: split users into cohorts by first payment and source, checked where people start dropping off massively, and suddenly a lot of things made sense. We found channels that had a “nice” CAC, but after a couple of months almost none of those customers stayed — and that was exactly what I hadn’t seen before. I went back to the commercial director not with excuses, but with a clear picture and concrete suggestions on what to cut and what to scale. Honestly, the only downside is that sometimes you have to pause the video and rewind - there’s a lot of material — but this is one of those rare cases when you feel you’re not just learning for the sake of it, you’re actually saving your marketing (and your job in the company).

Nick Gorpinevici / linkedin

CPO, P&L owner

«Ran pricing models over and over, couldn’t get to the right number. Looked at segments, looked at cohorts – Boom!»

What for. I own the P&L and pricing, and my task was simple on paper: find a price level where both revenue and margin grow without a spike in churn. In practice, I kept running into an “average hospital temperature”: one LTV, one CAC, one set of plans that were supposed to fit everyone but never gave a clear picture.

How I use it. After the cohort analysis lesson, I rebuilt the whole approach: first I segment customers by product use cases, acquisition channel, and initial plan, and only then I calculate unit economics inside each cohort. Now a price test is not one big experiment on the whole base, but a series of targeted hypotheses for specific clusters. This drastically reduces the cost of mistakes and speeds up decision cycles.

Did it pay off. Yes, and fairly quickly. In some cohorts we raised prices by 10–15% with almost no impact on churn; in others we made the entry softer and won on customer lifetime. Most importantly, the gap disappeared between “the model looks great” and a P&L that behaves unpredictably: now it’s clear which segments actually benefit from price changes and which are better left alone.

Pros and cons. The upside is that the cohort approach gives a transparent link between pricing decisions and real customer behavior over time, and it’s easier to talk to finance and sales when you show dynamics for specific groups. Another plus is that the tool scales well: you set up the slices once and then just plug in new pricing hypotheses. The downside is the entry barrier: until you flip your thinking from averages to cohorts, it feels like unnecessary complexity — but after the first successful iteration, you really don’t want to go back.

Ilia Lukiankin / linkedin

Senior Product Manager

Honestly, I signed up for this mostly to tick a box. I’m a Senior PM in big tech, surrounded by dashboards, my own analyst, retention squads - felt like I’d seen it all. But at some point it got embarrassing to admit: we’d been shipping “retention features” for six months, and I still couldn’t say clearly *who* was dropping off and *why*. After going through Alexey’s cohort breakdown, it became uncomfortably obvious that we’d been staring at an average retention curve and making decisions based on a “median user” who doesn’t actually exist.

Since then, I talk to the data in a completely different way: not “retention went down”, but “this cohort, with this entry scenario, starts falling apart in week three after this specific change”. It’s much easier for the team to prioritize because we see which hypotheses actually move cohorts and which ones just add noise to the overall chart. I won’t pretend everything is perfect now, but that feeling of banging my head against the wall is gone — at least we finally know *which* part of the wall to hit.

Vadzim Ananieu / linkedin

VC chief

“Reviewed financial models in an accelerator. God, why do so few people know about cohorts?”

I ran a venture fund, and I’m honestly blown away by the financial models founders send over. In 90% of cases it’s a pretty spreadsheet with “we’ll grow X times in 3 years,” built on faith‑based assumptions. No cohorts, no attempt to understand how the audience will change over time, just generic MRR curves and the immortal “we’ll bring churn down to 2%.” In the end it’s not a model, it’s a slide deck of hopes.

If someone sends me a financial model without cohorts, I send it back to be redone. If a founder can’t show how users from different channels and product scenarios behave by cohort, how retention works, and what *actually* drives revenue, that’s a red flag for me already at pre‑seed/seed, let alone Series A. A cohort‑based approach is not a luxury for later stages, it’s a must‑have for anyone asking for serious capital: it forces you to think in a driver‑based way instead of drawing pretty lines and hoping “it’ll somehow work out.”